This article appeared originally on InMilitary.com

Featured Image: U.S. Air Force Staff Sgt. Dylan Cantrell, 633rd Security Forces Squadron dog handler, and U.S. Army Spc. Levi Graham, 3rd MWD Detachment, carry their dogs, Largo, 633rd SFS MWD, and Jack, 3rd MWD Detachment MWD, respectively, during a ruck march in honor of National K9 Veterans Day at Joint Base Langley-Eustis, Virginia, March 13, 2020. (U.S. Air Force photo by Staff Sgt. Kaylee Dubois)

By Wes O’Donnell

Managing Editor of In Military, InCyberDefense and In Space News. Veteran, U.S. Army and U.S. Air Force.

Military veterans are uniquely suited to entrepreneurship. As a byproduct of their service, veterans have the stomach to take risks, the ability to deal with ambiguity and the composure and creativity to work under extreme pressure. They also possess an unparalleled focus on the “tribe” as the way to win a fight.

Despite a veteran’s natural advantages in the startup ecosystem, I am always on the lookout for tools that will make the journey easier. After all, when the military takes a cross-section of American society, people from all backgrounds and ethnicities are crammed into confined spaces under life or death conditions. After such experiences, civilian challenges seem trivial. In my time mentoring veteran entrepreneurs, I have seen vets adapt extremely well to the rigors of startup life. The mindset among vets seems to be “how hard could it be?”

A Serendipitous Meeting

Several months ago, I received an email out of the blue from a fellow veteran and real estate agent named Carl Sofranko, who said he had found my book “RISE – The Veteran’s Field Manual for Starting Your Own Business” on the shelves of his local library in Ohio. Feeling euphoric that this six-year-old book was still in circulation (at least in Ohio) and happy to chat with a fellow veteran, I agreed to hop on a call.

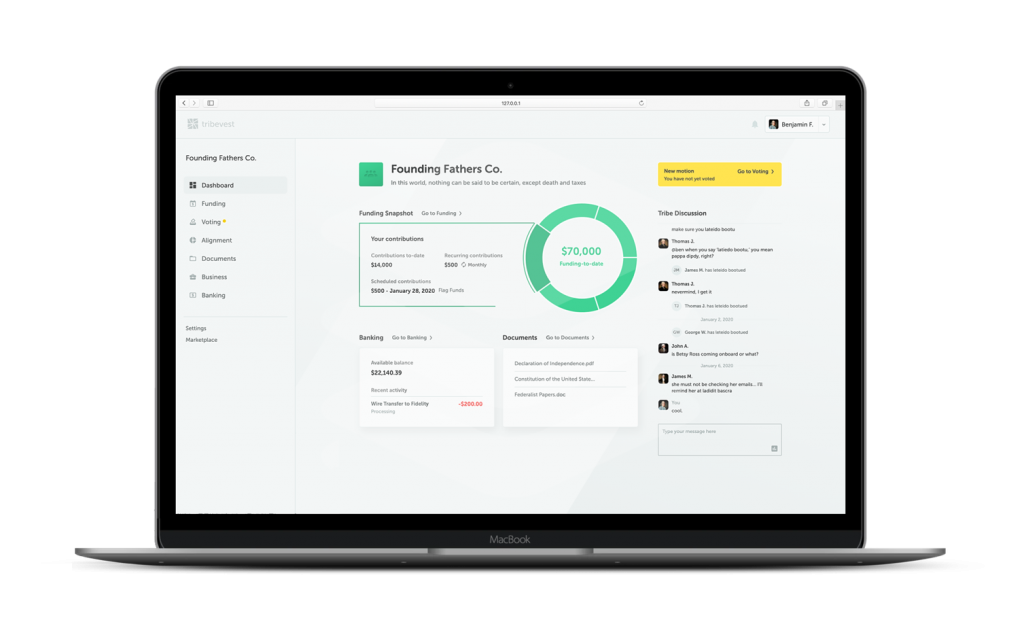

As part of the founding team, Carl was excited to share his involvement with a FinTech startup called Tribevest that allows users to create “a tribe” and pool money for a mutual goal. That goal could be anything from pooling resources for real estate investment or startup funds, to something as benign as saving for a vacation.

The big idea here was leveraging the power of the tribe, a group of people who already know and trust one another, to discover their mutual aspirations.

I was intrigued. Stumbling upon a unique idea in 2020 is rare; but more importantly, I instantly saw value here for veterans. After all, we exist in numerous tribes: it could be your branch, where you were stationed or something more granular like your fellow team or squadmates.

That first call led to others, and eventually to a call with Tribevest co-founder and CEO Travis Smith. While he’s not a veteran, I found Travis as likable, authentic and patriotic as they come. From my point of view, Travis has the best job in the world: He is helping other people’s dreams become reality. Because of the obvious value here for veteran entrepreneurs, I asked Travis if I could interview him to get the word out to the veteran community.

What follows is our conversation about Tribevest and entrepreneurship in general:

The Interview

Wes O’Donnell: Travis, thanks so much for taking the time to chat. I am smitten with the idea behind Tribevest and mildly shocked that no one has thought of this first. What motivated you to start this whole journey?

Travis Smith: Happy to chat, Wes! When we launched Tribevest two years ago, we wanted to build a platform that leveled the playing field for responsible middle-class Americans that were wanting to fund some type of venture or real-estate investment.

We knew that the upper-class had access to all sorts of tools via their country club networks and now with technology, we all can have access to those same tools and create a network of our own to achieve whatever it is we want to achieve.

Wes: So, what’s the big picture for Tribevest?

Travis: We want to enable an entire population to go out there and start a business or partake in an investment that wasn’t available or accessible before. They can do this by forming a tribe and pooling funds. The reason why we are so passionate about it is because we learn first-hand just how life-changing it can be when you come together with your tribe, form a group and pool those resources.

Wes: But Tribevest is more than just a platform to pool resources, it is a productivity app as well. In that regard, how is Tribevest different from something like Slack?

Travis: Collaboration tools are hot right now because of how hard it is to execute and how powerful it can be when you do it effectively. Our mindset is that if we are going to provide a platform for tribes to pool funds, why not create additional features that allow our members to unite around an idea, discuss priorities, vote on important decisions, and set rules to make your team’s relationship the #1 priority.

Travis: Collaboration tools are hot right now because of how hard it is to execute and how powerful it can be when you do it effectively. Our mindset is that if we are going to provide a platform for tribes to pool funds, why not create additional features that allow our members to unite around an idea, discuss priorities, vote on important decisions, and set rules to make your team’s relationship the #1 priority.

In fact, now you can open a business bank account on Tribevest and form an LLC with your group. We want to remove as many obstacles as possible to get our tribes to their dreams.

Wes: The idea of a “tribe” used to be called a subculture; for instance, veterans would be a “subculture” and they have what sociologists call “cultural capital,” because there is a certain way that they speak to each other and a certain way that they act around each other.

That veteran tribe is what I really want to get Tribevest in front of, because from the outside looking in, I see Tribevest as a tool for veterans to use on their journey to veteran entrepreneurship.

Having said that, there are many veterans who have that nine-to-five job, maybe they’re making a pretty good living, they have a family to support, they have a mortgage, they are living the “American Dream,” but they really want to start a business. How do they make that leap?

Travis: Tribevest is an enabler. If I wasn’t doing Tribevest, I would be working at my corporate nine-to-five job and doing as much side hustling as I possibly could in an effort to fulfill a dream of someday not having to do my corporate job and to turn my side gig into a fulltime job. Or to have multiple streams of income or multiple side gigs where I am no longer dependent or hostage to my paycheck.

Tribevest gives people the ability to take a step. If you’ve never been an entrepreneur, this is a safe way to start a business, whatever it might be. Whether you want to invest in real estate or you want to start some kind of franchise, or maybe you don’t know but one thing is for sure, the barrier or whatever that is that you are trying to get over requires capital.

If you want to leave and start a startup, you need capital to do that. If you want to invest in real estate, you need capital. That’s the biggest barrier of entry for all of us, and Tribevest is just a great way to take steps toward whatever that big dream is.

Wes: We are all told to graduate high school, go to college, get married, have a few kids, get a decent job, save for retirement and grow old and then die gracefully. I think that’s exactly how our society engineers it. I think the fact that the self-help industry is a multi-billion-dollar industry shows that there are a lot of people that want something more.

That’s the beauty of Tribevest and I think that’s why it’s so appealing when I first heard about it. It’s not only a fintech company, it’s not only a place to pool money with a group we trust, but it’s also tapping into that self-help market a little bit for real estate investors or entrepreneurs who want to be their own boss and be financially independent. Whether you planned that or not, I think Tribevest really appeals to people’s desire to break that chain… To try and get away from society’s rules.

Travis: Conformity. All those things you're supposed to do. And you were touching on it earlier: The American dream -- it’s not a home, it’s not a picket fence, it’s not all that to me. For me, it’s this human instinct… a yearning that we all have.

Wes: Just out of curiosity, do you have any insight into what your tribes are pooling money for?

Travis: One of the most exciting things about our business is seeing what people are passionate about and what they are pooling their money for. It can literally be anything. Real estate is an obvious one. There is a threshold of capital that you need to get into real estate, so Tribevest is great for that.

One of my favorites is that we had a group go on a reunion, the first one in years, and apparently their family had a home in the family for generations that was deteriorating. No one was stepping up to take care of it. Now they are using Tribevest to pool resources and restore that home for the next generation.

We have people who want franchises. Franchises have a very clear entry point, $50,000, $100,000 or $1,000,000; whatever that franchise is, you can use Tribevest because it’s really easy to put a schedule together on how much capital the group needs to raise to get entry there.

We have a tribe that’s wanting to build a co-working business and they are pooling money together to do that. Remember, it’s not just about pooling money; there is also this element about experiencing together, learning together and doing more things with people you know, like and trust.

So, it's not all that surprising that some people are coming together to do a trip of a lifetime. We had a group that always wanted to go to Africa. They came to us and started saving six months in advance and finally booked their safari.

Another great one was a guy from Ireland who was over here in the United States who wants to bring his friends to Ireland in the future. He put together a tribe to fund a whiskey barrel that they are buying in Ireland and when it's ready to be tapped they are financing the trip to Ireland to have that moment. They are using the whiskey barrel as a centerpiece of friendship.

Wes: That's something I never considered: Let's say a bunch of Vietnam veterans want to take a trip over to Vietnam; it happens quite frequently actually. To be able to have a group of former PBR veterans who were assigned to river patrol boats going up to the Mekong Delta and have them want to save for a group trip over there; That’s definitely a Tribevest benefit.

Travis: The most important piece is cementing the future. This group had been talking about going to Africa for years, but they never did it. Every time they got together, they talked about it and said they should do it. But for the first time ever someone can pull out an app, Tribevest, and share it with the group and say, “Hey guys, are we serious? Because if we are serious, let’s start putting a couple of hundred dollars a month toward it.”

Travis: The most important piece is cementing the future. This group had been talking about going to Africa for years, but they never did it. Every time they got together, they talked about it and said they should do it. But for the first time ever someone can pull out an app, Tribevest, and share it with the group and say, “Hey guys, are we serious? Because if we are serious, let’s start putting a couple of hundred dollars a month toward it.”

And that's what’s so cool. I often ask myself “does Tribevest deserve to exist?” and when I look at these tribes and what they are achieving with our platform, I have my answer.

Wes: Just to clarify a point you mentioned: you have the functionality in the app to be able to create an LLC, to go through that process, to request an EIN from the government. Is that something that's built-in?

Travis: Absolutely, it's an investment group in a box. It is all on the platform, so yes, you can file in all 50 states. When the state gets back to you with your articles of organization, your operating agreement and your EIN, it all goes immediately into your shared dashboard, so you'll have all your documents there and accessible.

What is so cool about our technology is it is progressive in that it gets easier and easier to work with Tribevest the longer you work with us. The fact that you've already got your EIN and everything else, you don't need to submit all that to the bank, it's already in your Tribevest folder so when you want to open up a business bank account we make it super simple to do that. We do it all online too which is a new thing as far as business banking accounts go.

Wes: I think what surprised me the most about Tribevest is that it is free to create a tribe and start pooling money. It is only once the tribe pivots to a business banking account and starts transacting as a business that you charge a fee; and even then, it is only $5 per month if billed yearly.

Travis: You nailed it. And that's also a measure of “did we help,” because if they formed a business bank account that also means they are going to be transacting together. So, we can say, “Hey, they're doing it!” We helped them do it and so it's a celebration moment and it's also a great conversion.

Like you said, it's free all the way up to the point where you do form a business banking account and then it's $5 per person up to $25 per group. There are actually some discounts we will have available for this particular audience, but that's not our main business model.

Our main business model is once they are successful in transacting, do they need a lending partner, and can we introduce them to a lending partner that can help them? We would get a referral fee for that. Not that they must use our referral partners, but we make it so convenient and have vetted the best ones out there that it just makes sense.

Do they need insurance before they close on their mortgage? Can we help them with that? Do they need a property manager? If they find their property manager through the Tribevest marketplace network, we will get a little referral fee. Ultimately, we are really trying to limit the cost to the investor group as much as possible.

Wes: Wrapping up, what would be your elevator pitch to veteran entrepreneurs who might find value on the Tribevest platform?

Travis: I read an article on Forbes that said there are 2.5 million veteran entrepreneurs, which just tells you a ton about their spirit. The veteran community is way ahead of the rest of us when it comes to a tribe. They know first-hand the power of the tribe. They know first-hand how to achieve a shared goal and mission. They know how to do it and they know how to work together toward something serious; not just playing a sport which is where most of us learn how to be on a team, but working toward a shared mission that has serious implications. They know that victory is way better when you share it as a group and it's a special sense of fulfillment.

The Tribevest team

The Tribevest team

The other way that they are way ahead of the rest of us is they have a network they trust. Most of out there, we have our friends and our immediate network. Then we have our family and that's really it.

And of course, veterans have that plus their military family: the people they've served with that they trust and want to do more things with. They have a bond that already exists, their trust that already exists, the knowing of the power that comes with the tribe and achieving more than you can on your own. This puts them in an incredible position to leverage Tribevest.

Wes: I'm in a complete agreement with you. It almost looks like Tribevest was custom made for the veteran community. It's that good of a match from my perspective.

Travis: Shared values, right? What makes Tribevest successful are those values that are instilled in our veteran and military community. Veterans are really an exciting customer for us.

Wes: Travis, thank you for your time. I really want to get Tribevest out there in front of veteran entrepreneurs. I have no doubt that you have built something special here.

Travis: My pleasure, Wes. Take care.

Get more information on this incredible platform at Tribevest.com. If you are a veteran that is using Tribevest to fund your goals, please let me know at wodonnell@apus.edu. InMilitary would love to interview you.

The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.